As 2024 unfolds, Indonesia’s economy is navigating a complex landscape marked by both resilience and emerging challenges. The nation’s economic performance in the first half of the year has demonstrated considerable strength, particularly in household consumption and fixed investment. However, recent indicators suggest a potential slowdown, raising questions about the country’s growth trajectory for the remainder of the year and beyond.

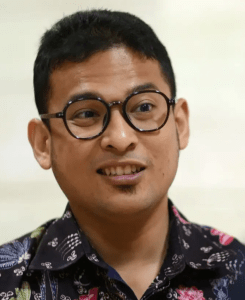

Here is a presentation by Fithra Faisal Hastiadi, a Senior Economist at PT Samuel Sekuritas Indonesia, a leading securities and investment company, where he provides economic analysis and insights to support the company’s strategic decisions and client services. With over 18 years of teaching experience, Fithra is a Lecturer at the Faculty of Economics and Business, Universitas Indonesia, where he specializes in international economics, trade policy, and economic development. He is also the Co Founder of Next Policy, a think tank that promotes evidence-based policy making and public discourse in Indonesia and beyond. He holds a PhD in International Economics from Waseda University, Japan, and has published multiple books and articles on trade strategy, regional integration, productivity, and production networks in East Asia and ASEAN. He is passionate about advancing economic knowledge and policy innovation for a more inclusive and sustainable future.

Growth Dynamics in 2024

Indonesia’s economy expanded by 5.05% year-on-year in the second quarter of 2024, slightly down from the 5.11% growth in the first quarter. This performance was largely in line with market expectations but below some forecasts. The deceleration can be attributed primarily to a sharp decline in government spending growth, which fell significantly after a surge driven by election-related expenditures earlier in the year. Despite this, household consumption remained robust, and fixed investment accelerated, providing a strong foundation for the economy.

On the trade front, both exports and imports recorded substantial growth, contributing positively to GDP. However, the manufacturing sector showed signs of strain, with output and new orders declining. The S&P Global Indonesia Manufacturing PMI fell to 49.3 in July, marking the first contraction in factory activities since August 2021. This contraction signals a challenging period ahead for the manufacturing sector, which could weigh on overall economic growth.

Inflation and Monetary Policy

Inflation in Indonesia has been on a downward trend, with the annual rate falling from 2.51% in June to 2.13% in July 2024, marking the lowest inflation rate since February 2022. This decline was driven by a moderation in food prices and slower price increases in several other sectors. However, the softer inflation reflects lagging consumption, which, combined with a contraction in the PMI, could hinder the government’s target of achieving 5%+ economic growth for the year.

Bank Indonesia (BI) has maintained its benchmark interest rate at 6.25% during the July meeting, in line with consensus expectations. While the central bank has been cautious in its approach, the narrowing gap between Indonesia’s rates and the US Federal Reserve’s funds rate, coupled with the expectation of a widening current account deficit, could prompt BI to consider further rate hikes in the coming months.

External Factors and Global Impact

The global economic environment remains a significant factor influencing Indonesia’s outlook. The ongoing US-China trade tensions have the potential to benefit Southeast Asia economically. However, Indonesia may lag behind its regional peers in reaping these benefits due to restrictive policies. Moreover, the Federal Reserve’s decision to maintain high interest rates, combined with Indonesia’s twin deficits, could exert pressure on the rupiah and prompt BI to adopt a more hawkish stance.

Indonesia’s foreign exchange reserves have seen a significant increase, reaching USD 145.4 billion in July 2024, providing a substantial cushion against external shocks. However, this strong reserve position comes with challenges, particularly as recent data shows a decline in exports and manufacturing activity, which could constrain the growth of reserves in the coming months.

Looking Ahead: Challenges and Opportunities

As Indonesia moves into the latter half of 2024, several challenges loom on the horizon. The country’s trade surplus has shrunk, and the current account deficit is expected to widen, reflecting softer export growth and weaker global demand. The manufacturing sector’s contraction, coupled with declining consumer confidence, suggests that the economy may face headwinds in maintaining its current growth momentum.

However, there are also opportunities for Indonesia to bolster its economic prospects. The government’s focus on infrastructure development and efforts to attract foreign investment could support long-term growth. Additionally, the potential for a more accommodative monetary policy, if global inflationary pressures ease, could provide a boost to domestic consumption and investment.

Conclusion

Indonesia’s economic outlook for 2024 and beyond is marked by a delicate balance of resilience and emerging challenges. While the first half of the year has shown solid growth, the recent data points to potential headwinds that could temper this trajectory. As global uncertainties persist, Indonesia’s policymakers will need to navigate these challenges carefully to sustain economic stability and growth in the years to come.