The changing face of India by Gaurav Singhvi

Last month I traveled to Surat (a metro city in Gujarat) from Mumbai. It was morning –

evening trip, however a call from my hometown Jaipur (the capital city of Rajasthan)

required me to travel there immediately. From the time I received the call to the time I

landed in Jaipur was 5 hours.

This was unbelievable, had it been the India that we have known, I would have taken 18-20hours to reach Jaipur. May have boarded a train without reservation or would have traveled back to Mumbai and then to Jaipur.

So what has changed here, Indian cities are efficiently bridged with each other. India is now connected like never before. Not only our average travel time has improved significantly but we have modified our infrastructure materially. India considered to be a third world country for decades now. From contributing 25% of the World GDP, before it was invaded by Britishers in 17th century, it was down to 4% at the time of independence. Though it went through the turbulent 60 years before we became a trillion dollar economy in 2007, but the next trillion dollar came in just 8 years and the 3rd trillion dollar in 7 years and we are now touching 3.6 Trillion dollars being the 5th largest economy in the world. What amazes me is the pace at which it is growing. If we are to believe the S&P global market intelligence projections, India going to be $7 Trillion economy by 2030-31. Almost doubling from here.

So what have we done right to catch global attention:

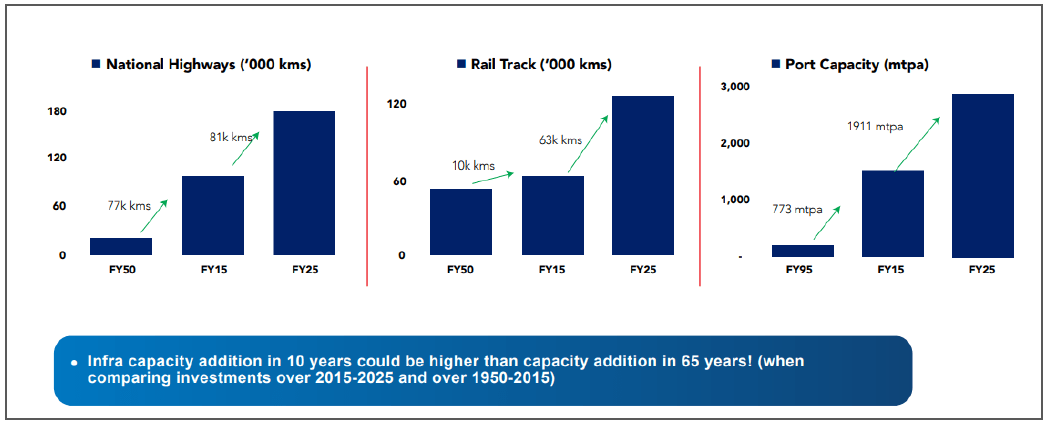

Infrastructure:

India added 65 airports in 60 years of our independence (1947-2007), but have added 72

new airports in past 9 years and expected to add 100 more airports by year 2040. When it

comes to Rail infrastructure it has added 10,000 Kms for rail tracks in first 65 years of

independence but have added 6 times of that figure in last 10 years. National Highway

Authority of India (NHAI) is constructing 34 kms of National Highway per day.

Digital Stack:

I think constructing one of the best and finest digital stack has been the moment of glory for India. This robust stack is handling whopping 466 Mn average daily transaction. In a recently released report on currency and finance, the Reserve Bank of India (RBI) noted that the UPI has seen a tenfold increase in volume over the past four years, increasing from 12.5 billion transactions in 2019-20 to 131 billion transactions in 2023-24, which is 80 per cent of all digital payment volumes. Its one of the finest way to move from cash economy to a white economy. On top of that, India is now helping developed economies build there Digital efficiency across administrative and business spectrum.

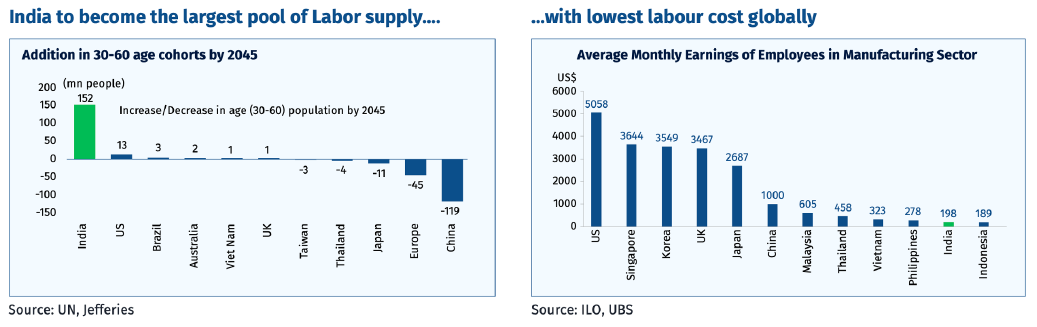

Furthermore, the Demographic, robust policy Initiatives, Fiscal & Monetary prudence has not only helped India sustain the tough covid and post covid period but has also set it on a superior growth trajectory. India remains one of the most popular FDI destinations in the world. According to the World Investment Report 2023 India ranked as the eighth-largest recipient of FDI in 2023, the third-highest recipient of FDI in greenfield projects and the second-highest recipient of FDI in international project finance deals.

The corporate tax rates reduced from 34 to 25% and now are most competitive. Banks have cleaned their balance sheets. Indian Scheduled commercial Bank’s Non Performing Assets (NPAs) are multiyear Low at 2.8%, fiscal deficit as a %of GDP is on continuous decline, 25% of the worlds working population is in India, and hence it is slowly becoming office to the world, it is leading sustainability initiatives, it has now Largest source of cost effective skilled labor supply, and the list goes on.

Bombay Stock exchange (BSE) has delivered returns in excess of 16% (Compounding Annual Growth Return) for over a 40-year period now. And during this period, we have seen worse times including Global Financial Crisis, Taper Tantrum, Recessions, Assassinations, Political instability, Tariff wars, Climate change, Natural calamities, War, Changing geo political situations, Covid etc. But question lies, can India see similar or better growth in future also!

Answer to it is, if India continues to progress the way it is right now, odds are that answer

will be an emphatic yes.

Gaurav Singhvi

Director

Trufid Investment Advisors Pvt. Ltd.

Mumbai (India)